Hi All..!! I

just cannot express how happy I am to see all of us alive at the doomsday.

News these days are quite funny huh. Funny to an extent that even NASA has to give explanations that earth would survive for a lot more billion years.

Coming out

from the doom’s day story, I would like to thank you all for your appreciation

for my last article on EPF Challans. A lot of you asked if employees could also

check their PF Status through the portal and here’s the answer. Yes, if you’re

an employee in any organization where your provident fund is being deducted,

you’d be able to check the status of the same. A couple of days before, I read

an article about the same which I’m very pleased to share with you. Please go

through it and share your views with us.

As we were discussing

about the revolutionary activities in HR this year, today I’m, going to

enlighten you about the online filing of ESI Monthly Contributions. Many of you

may already be aware of this concept but there are still a lot of employers/organizations

who are not friendly of this brilliant system upgrading by the Government. From

this year itself, employers have been provided with the facility of filing

monthly ESI Challans via ESI Portal.

So, how do we utilize this benefit of filling the Monthly Contributions (MC) online? Let's move ahead one by one.

Understanding the User Panel

1. Collect the

User-Id and Password from ESIC Officials. After receiving the User-Id and

Password, please open ESIC portal www.esic.in.

2. Hit the “Click

here to Login” button and enter your username and password.

3. On

successful login, the application displays hyperlinks under each of the modules

as shown in following figure.

4. Monthly

contribution and Challan Generation is a two step process –

a. Purify/Update

Data – Make sure the employee/IP details are correct in the computer system. For

this you need to add new employees and/or add existing IPs if anyone is missing

as well as remove any incorrect IPs.

b. File Monthly

Contribution and Generate Challans.

5. Before

registering new IP (Insured Person) of Filling Challans, make sure employer

details are filled correctly. Click on “Update Employer Details” for this purpose

and submit your details as per the system requirements.

Steps to do before filing MC –Data Purification

1. Main unit

–Main Unit can file contribution for Employees who are with the main-unit only.

2. Sub-unit

–Sub-unit can file contribution for Employees who are assigned with sub-unit.

3. Main-unit if

desires to file contribution for sub-unit then main-unit should login with

sub-unit user-id and password.

4. Ensure the

current IPs available with Employer are mapped in the System. To check this, do

the following.

a. Data

Migration/Insert IP Details Download

Existing IPs & Find out Missing IPs. Explained in subsequent pages.

b. Data

Migration/Insert IP Details Insert

missing IPs (This is valid for only those IPs who already have „Insurance

Number‟

but the data is missing against the employer)

i. Use online screen to insert (if only

very few IPs are missing).

ii. Use excel upload to upload missing

IPs in bulk

c. Make

sure all the new Employees (Those who doesn’t have Insurance Number) are registered for the

Employer -Register

New IP .

Note: The 10

digit IP number given to an IP is valid for life time and same number can be

used anywhere in India. i,e., if a person changes job from one state to another

or one region to another the IP number does not change.

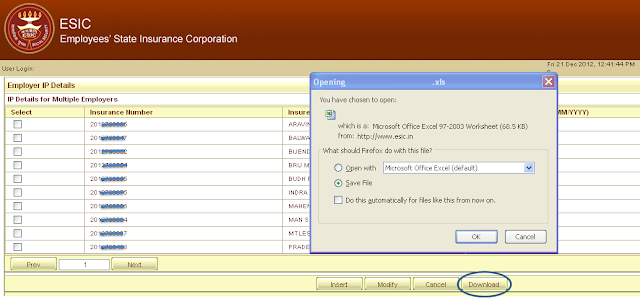

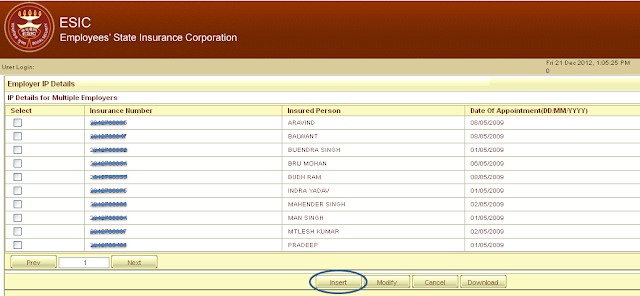

Checking IPs associated with the Employer in the system

1. Click on

Insert IP Details Link.

2. You will get

another window with list of IPs from where you can download details of Insured Persons

(IPs).

3. Employer may

find everything correct or some IP missing or some incorrect IPs present in the

list.

4. In case IP

is missing, employer can Insert the IPs which is explained later.

5. Incorrect

IPs can be removed from the list while filing contribution.

Insert IP into the Employer list (IPs already have IP number)

1. Employers

can Insert IP using “Insert IP” link if the IP is not in the computer system or

the IP is/was working with another Employer. IP can be inserted in two ways .

a. Employer can insert IPs one by one

using the screen.

b. Excel / bulk upload (to add many IPs

together) -Download the template. Provide the details and upload up to 500

Employees at a time.

Registering New Employee into ESIC –Generate Insurance Number Figure

1. Click on

Register New IP link.

2. You will get

another window to register new Employees.

3. Employer

Code will populate by default. Employers should select continue to load “IP

Registration Page‟.

Filing Monthly Contribution

1. Once Data

Purification is complete / Employee records are cleaned up, MC can be filed.

2. Click File

Monthly Contributions link to file the contribution of the employer for a

particular month.

3. You’ll be

redirected to “Monthly Contribution Page” where you’d be asked to fill in

contribution month and year and details.

4. There are

two ways to file contribution: Excel Upload (see following image) and Online Entry of Contribution.

Note: Kindly turn

OFF ‘POP UP BLOCKER’ if it is ON in your browser. Follow the steps given to

turn off pop up blocker. This is required to upload MC excel, modify or print

Challan/ TIC.

After Submitting the Monthly Contribution

Generate and Print Challans

Modify Challans

View Contribution History

I assume this information would be beneficial to you and help you manage your payroll in a more organized manner. Should you need any more information, I'm here to assist you on the same.

See you this Monday.. Till then, enjoy the doomsday. Happy Living..!!

Thank you soo much for this important and useful information,i actually forwarded to my HR Person. I hope it will help him alot, you do a very informative things in your every article :)

ReplyDelete