The

year 2012 is ending soon and I’m pretty sure, all of us are prepared to welcome

the New Year, 2013. Before we welcome the fresh year, let’s look back and enjoy

the flashbacks of 2012 and analyze the happenings so as to get ready for 2013.

A

lot of ups and downs were seen this very year. Politics in India was probably

the hottest topic, Bollywood star’s demise being the next. Not to forget the London

Olympics, and Arvind Kejriwal’s fight against corruption campaign. On a light

note, I would also count PSY’s Gangnam Style as one of the hottest trends this

year.

Moving

further to the Human Resources News in 2012, we read about the improved position

of women in the industry, decrease in salaries in banking sector, differentiated

strategies of hiring in Microsoft and Google and much other. Here,

I’m going to discuss one of the biggest revolutions made in the EPF Sector that

simplified filing of EPF Challans and saved employers from errors that used to

occur due to conventional paper work methods.

With

effect from April 2012, EPFO Launched online receipt of Electronic Challan cum

Return (ECR). Any remittance to be made by the employer was to be done only

after generating Challan from the Employer Portal of EPFO. Though every organization’s

Challans are filed this way now, a lot of employers who leave this headache on

other companies might not still be aware of this new system.

For

those who still don’t know the process, I’m explaining below all the steps

required to file Challans online through the EPF portal and those who know the

procedures already can review if they are doing everything correct.

PROCESS FLOW OF ECR

Preconditions:

1. The employer has registered his/her establishment

on the employer e-sewa portal.

2. The employer has downloaded the ECR file

format and prepared the ECR text file. (For details click here)

So, how do we file monthly Challans through EPF Portal?

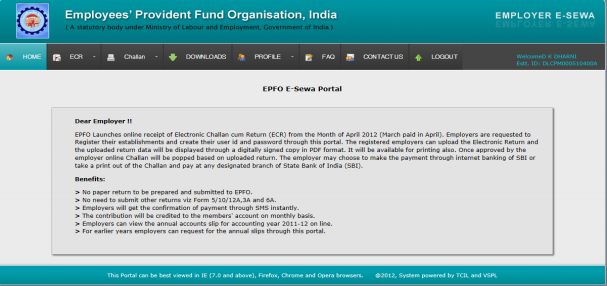

1. Login

to the employer e-sewa portal here.

2. After

login, you’ll see the following screen

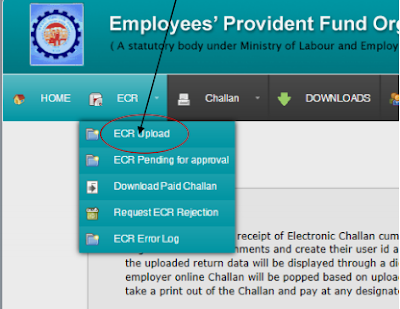

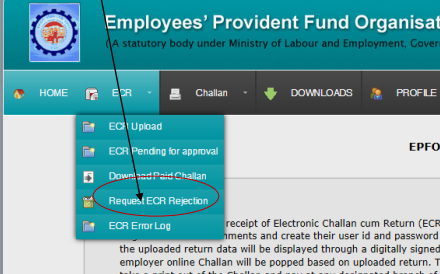

3. Click

on the ECR at the top Menu Bar. You will find the various options. Click ECR

UPLOAD.

Following screen will appear.

4. Select

the text file you have to upload from the location where you have saved it.

Check the Wage Month and year for which you are going to upload the ECR. Select

the correct WAGE MONTH/YEAR and click SUBMIT button.

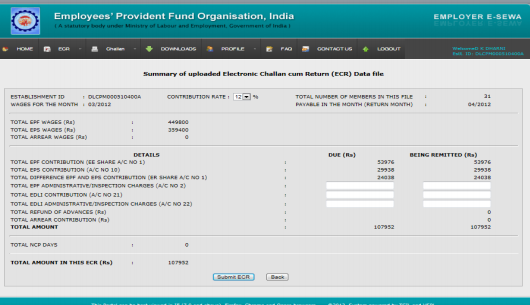

5. If

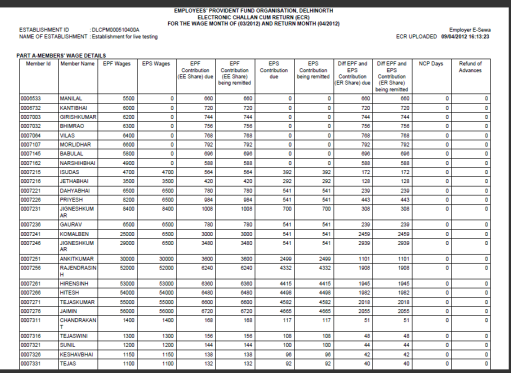

your text file has been prepared correctly, the Summary sheet as follows will

appear.

6. Enter

the additional details regarding EDLI and EPF/EDLI Administrative and

Inspection charges. Check the Contribution rate also. By default it is 12%. If

applicable for your establishment, you can change it to 10%. Click SUBMIT ECR button.

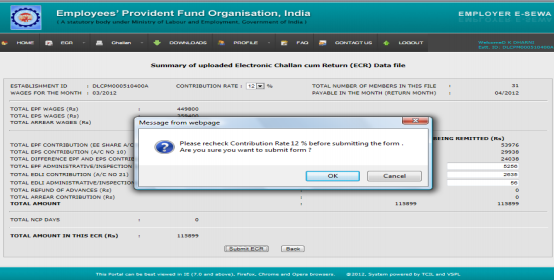

7. An

alert will appear to confirm the Contribution rate. Click OK and again click

SUBMIT ECR button.

8. A

digitally signed PDF file with date and time of upload will appear on the

screen.

Note: In case the number of

members in the ECR file is more than 200, please wait till you get an SMS alert

to view/download the digitally signed PDF file.

Click on the PDF FILE icon to download the file and verify the data with

the data of the ECR text file uploaded by you.

Note:

The PDF file that is displayed is digitally signed by EPFO for security purpose

and no signature is required.

This

step is also available at the following link (ECR PENDING FOR APPROVAL)

9. The

digitally signed PDF will look like the following screen.

10. After

you have satisfied yourself with the correctness of the data, click APPROVE

button. An alert will come on Approval. Click OK.

11. On

approval of the ECR file, a Temporary Return Reference Number (TRRN) for the

uploaded ECR file will be generated and the next screen that will appear will

display the Challan and Acknowledgement slip for uploaded file.

Click CHALLAN RECEIPT File for downloading and printing the Challan.

This

step is also available at the following link (REQUEST ECR REJECTION)

12. The

Challan will look as follows: After Printing, manually fill in the details

under “For establishment use only”.

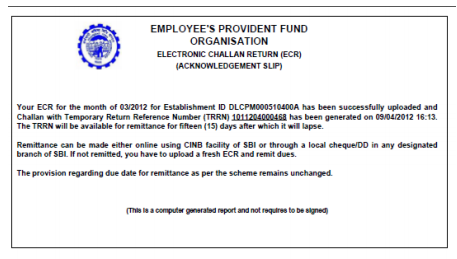

13. The

ECR Acknowledge slip will be as follows.

The challan generated on approval of

ECR will lapse after 15 days if remittance is not made.

Till this stage the

employer can request for rejection of the approved ECR. However if remittance

is made against the ECR, it cannot be rejected.

14. For

Remittance there are two options:

a. If the employer is a CINB (Corporate Internet

Banking) customer of SBI, then he/she can make online payment through the

online SBI portal of SBI.

b. Otherwise the remittance can be made through demand

draft/local cheque in any designated branch of SBI.

15. Once

the cheque against the Challan is realized, you will get SMS

alert. With this the ECR filing process for the month will be complete.

Should you have any queries regarding the

above process, please let us know. You can also share your feedback with us. We’d continue with other remarkable events

in HR Industry this Friday.

Such an Informative Article you wrote i must share it on my Linkedin and tell refer this other people who need this thing.

ReplyDeleteThank again, Beautifully explained, creatively mentioned,

Thanks Pimanpower

Such a nice and very informative blog am really appreciate to your blog thanks for sharing. Power Consultant

ReplyDeleteGreat things you’ve always shared with us. Just keep writing this kind of posts.The time which was wasted in traveling for tuition now it can be used for studies.Thanks HR consulting

ReplyDelete