Monday, 31 December 2012

Sunday, 30 December 2012

Challenges to Employees - New EPFO Standards

Greetings from PI Manpower at this very last

day of the year 2012..!! People around the world are in mood of celebrations

and so are we. However, for the employees in India, there are more challenges to

come.

Greetings from PI Manpower at this very last

day of the year 2012..!! People around the world are in mood of celebrations

and so are we. However, for the employees in India, there are more challenges to

come.

As per the latest circular from Employees Provident Fund Organization (EPFO), several types of allowances applicable to

employees will now onwards be added to their basic salary. However, it’s yet to

be mentioned which allowances are to be included. This will certainly lead to an

increase in the value of PF contributions and consequently, all salaried

employees would have a lower-in-hand salary. At present Provident Fund of an employee is

calculated based on Dearness Allowance (DA) and basic wages @12% from employee

as well as employer.

It was observed by the EPFO officials that

most of the organizations often break-up basic salary into a variety of

allowances to decrease their PF burden. The Madhya Pradesh High Court and the

Madras High Court recently pronounced that while computing PF contributions,

different kinds of employee allowances paid by the employer shall be

considered. Based on this, EPFO undertook a series of audits on Indian

companies to facilitate recovery of several PF contributions.

R.C. Mishra, the central PF commissioner

directed in the new circular that going forward compliance actions and probes

against erring employers shall not go beyond preceding seven financial years

because such inquiries often do not lead to the identification of the rightful

recipients. Although organizations may welcome this move towards time

bound queries, which protects them from needless harassment, it essentially

seems to be anti-worker in its structure. Firstly, not many employees check

their PF deposits regularly as the EPF statement rarely reaches them on time.

Secondly, they consider it best not to complain against their respective

employers when they are in active service, fearing the loss of their jobs. In

virtue of this, a number of trade unions and labour boards have denounced the

provision that limits the scope of inquiry period against the defaulter

companies.

The six-page circular also specified that

workers will have to file specific returns regarding statutory PF deductions,

thereby benefitting the companies submitting their records for assessment.

However, the circular states clearly, “There shall be no assessment without

identifying individual members in whose account the fund is to be credited.”

The consequences of new circular are far

reaching affecting approximately six crores workers all across India. The

release of this new circular was defended in terms of “bringing transparency in

the system”, however, the labour ministry doesn’t seem much convinced in such

politically sensitive times. Some of its officials have indicated that the

ministry would possibly ask for the withdrawal of the new circular. According

to one of its unnamed officials, “The labour ministry is setting up a

committee comprising legal experts to evaluate the circular, (on) whether it is

complying with the EPF Act, 1952.”

Meanwhile, on December 18, 2012, Ravi

Mathur, the new Central PF Commissioner released a new circular specifying that

the earlier circular be kept in abeyance till further orders.

Monday, 24 December 2012

Friday, 21 December 2012

Revolutions in HR India 2012 - ESI Challans

Hi All..!! I

just cannot express how happy I am to see all of us alive at the doomsday.

News these days are quite funny huh. Funny to an extent that even NASA has to give explanations that earth would survive for a lot more billion years.

Coming out

from the doom’s day story, I would like to thank you all for your appreciation

for my last article on EPF Challans. A lot of you asked if employees could also

check their PF Status through the portal and here’s the answer. Yes, if you’re

an employee in any organization where your provident fund is being deducted,

you’d be able to check the status of the same. A couple of days before, I read

an article about the same which I’m very pleased to share with you. Please go

through it and share your views with us.

As we were discussing

about the revolutionary activities in HR this year, today I’m, going to

enlighten you about the online filing of ESI Monthly Contributions. Many of you

may already be aware of this concept but there are still a lot of employers/organizations

who are not friendly of this brilliant system upgrading by the Government. From

this year itself, employers have been provided with the facility of filing

monthly ESI Challans via ESI Portal.

So, how do we utilize this benefit of filling the Monthly Contributions (MC) online? Let's move ahead one by one.

Understanding the User Panel

1. Collect the

User-Id and Password from ESIC Officials. After receiving the User-Id and

Password, please open ESIC portal www.esic.in.

2. Hit the “Click

here to Login” button and enter your username and password.

3. On

successful login, the application displays hyperlinks under each of the modules

as shown in following figure.

4. Monthly

contribution and Challan Generation is a two step process –

a. Purify/Update

Data – Make sure the employee/IP details are correct in the computer system. For

this you need to add new employees and/or add existing IPs if anyone is missing

as well as remove any incorrect IPs.

b. File Monthly

Contribution and Generate Challans.

5. Before

registering new IP (Insured Person) of Filling Challans, make sure employer

details are filled correctly. Click on “Update Employer Details” for this purpose

and submit your details as per the system requirements.

Steps to do before filing MC –Data Purification

1. Main unit

–Main Unit can file contribution for Employees who are with the main-unit only.

2. Sub-unit

–Sub-unit can file contribution for Employees who are assigned with sub-unit.

3. Main-unit if

desires to file contribution for sub-unit then main-unit should login with

sub-unit user-id and password.

4. Ensure the

current IPs available with Employer are mapped in the System. To check this, do

the following.

a. Data

Migration/Insert IP Details Download

Existing IPs & Find out Missing IPs. Explained in subsequent pages.

b. Data

Migration/Insert IP Details Insert

missing IPs (This is valid for only those IPs who already have „Insurance

Number‟

but the data is missing against the employer)

i. Use online screen to insert (if only

very few IPs are missing).

ii. Use excel upload to upload missing

IPs in bulk

c. Make

sure all the new Employees (Those who doesn’t have Insurance Number) are registered for the

Employer -Register

New IP .

Note: The 10

digit IP number given to an IP is valid for life time and same number can be

used anywhere in India. i,e., if a person changes job from one state to another

or one region to another the IP number does not change.

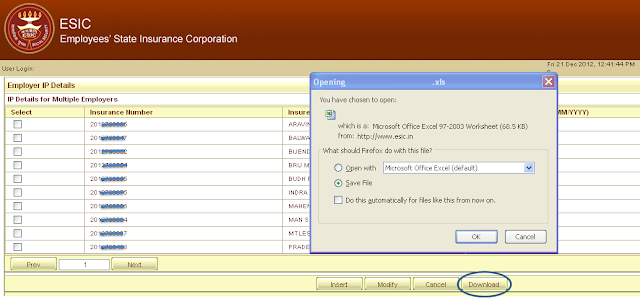

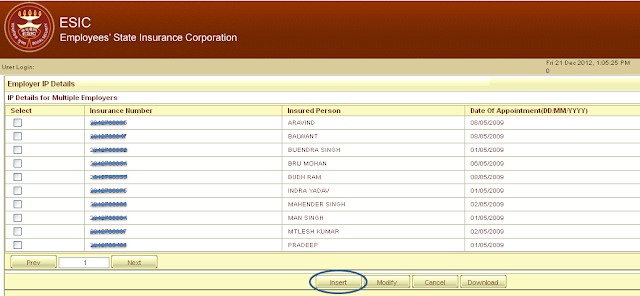

Checking IPs associated with the Employer in the system

1. Click on

Insert IP Details Link.

2. You will get

another window with list of IPs from where you can download details of Insured Persons

(IPs).

3. Employer may

find everything correct or some IP missing or some incorrect IPs present in the

list.

4. In case IP

is missing, employer can Insert the IPs which is explained later.

5. Incorrect

IPs can be removed from the list while filing contribution.

Insert IP into the Employer list (IPs already have IP number)

1. Employers

can Insert IP using “Insert IP” link if the IP is not in the computer system or

the IP is/was working with another Employer. IP can be inserted in two ways .

a. Employer can insert IPs one by one

using the screen.

b. Excel / bulk upload (to add many IPs

together) -Download the template. Provide the details and upload up to 500

Employees at a time.

Registering New Employee into ESIC –Generate Insurance Number Figure

1. Click on

Register New IP link.

2. You will get

another window to register new Employees.

3. Employer

Code will populate by default. Employers should select continue to load “IP

Registration Page‟.

Filing Monthly Contribution

1. Once Data

Purification is complete / Employee records are cleaned up, MC can be filed.

2. Click File

Monthly Contributions link to file the contribution of the employer for a

particular month.

3. You’ll be

redirected to “Monthly Contribution Page” where you’d be asked to fill in

contribution month and year and details.

4. There are

two ways to file contribution: Excel Upload (see following image) and Online Entry of Contribution.

Note: Kindly turn

OFF ‘POP UP BLOCKER’ if it is ON in your browser. Follow the steps given to

turn off pop up blocker. This is required to upload MC excel, modify or print

Challan/ TIC.

After Submitting the Monthly Contribution

Generate and Print Challans

Modify Challans

View Contribution History

I assume this information would be beneficial to you and help you manage your payroll in a more organized manner. Should you need any more information, I'm here to assist you on the same.

See you this Monday.. Till then, enjoy the doomsday. Happy Living..!!

Monday, 17 December 2012

Revolutions in HR India 2012 - EPF Challans

The

year 2012 is ending soon and I’m pretty sure, all of us are prepared to welcome

the New Year, 2013. Before we welcome the fresh year, let’s look back and enjoy

the flashbacks of 2012 and analyze the happenings so as to get ready for 2013.

A

lot of ups and downs were seen this very year. Politics in India was probably

the hottest topic, Bollywood star’s demise being the next. Not to forget the London

Olympics, and Arvind Kejriwal’s fight against corruption campaign. On a light

note, I would also count PSY’s Gangnam Style as one of the hottest trends this

year.

Moving

further to the Human Resources News in 2012, we read about the improved position

of women in the industry, decrease in salaries in banking sector, differentiated

strategies of hiring in Microsoft and Google and much other. Here,

I’m going to discuss one of the biggest revolutions made in the EPF Sector that

simplified filing of EPF Challans and saved employers from errors that used to

occur due to conventional paper work methods.

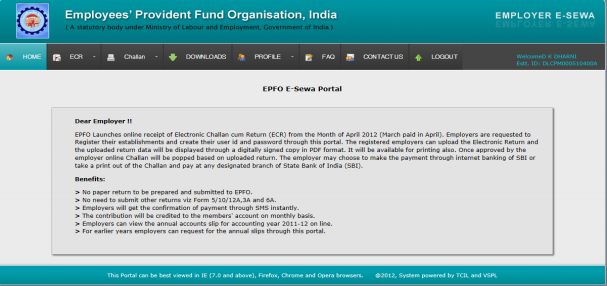

With

effect from April 2012, EPFO Launched online receipt of Electronic Challan cum

Return (ECR). Any remittance to be made by the employer was to be done only

after generating Challan from the Employer Portal of EPFO. Though every organization’s

Challans are filed this way now, a lot of employers who leave this headache on

other companies might not still be aware of this new system.

For

those who still don’t know the process, I’m explaining below all the steps

required to file Challans online through the EPF portal and those who know the

procedures already can review if they are doing everything correct.

PROCESS FLOW OF ECR

Preconditions:

1. The employer has registered his/her establishment

on the employer e-sewa portal.

2. The employer has downloaded the ECR file

format and prepared the ECR text file. (For details click here)

So, how do we file monthly Challans through EPF Portal?

1. Login

to the employer e-sewa portal here.

2. After

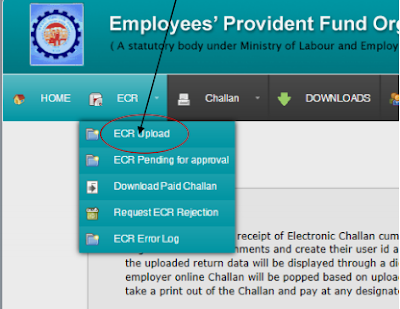

login, you’ll see the following screen

3. Click

on the ECR at the top Menu Bar. You will find the various options. Click ECR

UPLOAD.

Following screen will appear.

4. Select

the text file you have to upload from the location where you have saved it.

Check the Wage Month and year for which you are going to upload the ECR. Select

the correct WAGE MONTH/YEAR and click SUBMIT button.

5. If

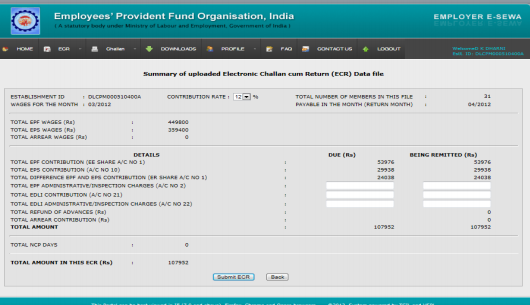

your text file has been prepared correctly, the Summary sheet as follows will

appear.

6. Enter

the additional details regarding EDLI and EPF/EDLI Administrative and

Inspection charges. Check the Contribution rate also. By default it is 12%. If

applicable for your establishment, you can change it to 10%. Click SUBMIT ECR button.

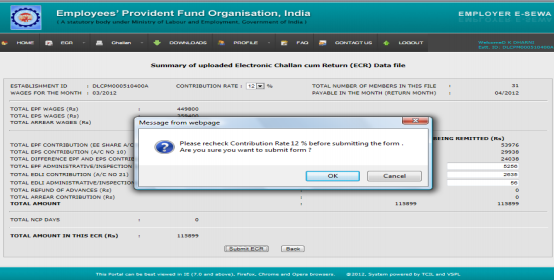

7. An

alert will appear to confirm the Contribution rate. Click OK and again click

SUBMIT ECR button.

8. A

digitally signed PDF file with date and time of upload will appear on the

screen.

Note: In case the number of

members in the ECR file is more than 200, please wait till you get an SMS alert

to view/download the digitally signed PDF file.

Click on the PDF FILE icon to download the file and verify the data with

the data of the ECR text file uploaded by you.

Note:

The PDF file that is displayed is digitally signed by EPFO for security purpose

and no signature is required.

This

step is also available at the following link (ECR PENDING FOR APPROVAL)

9. The

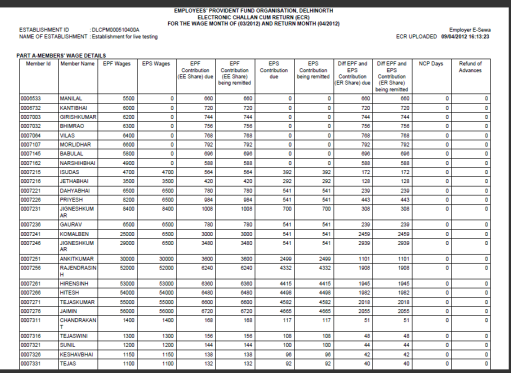

digitally signed PDF will look like the following screen.

10. After

you have satisfied yourself with the correctness of the data, click APPROVE

button. An alert will come on Approval. Click OK.

11. On

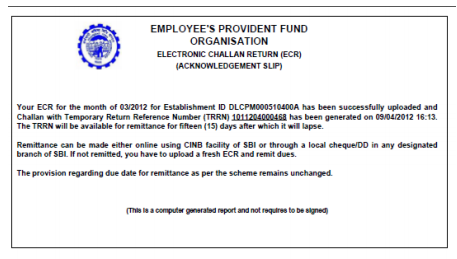

approval of the ECR file, a Temporary Return Reference Number (TRRN) for the

uploaded ECR file will be generated and the next screen that will appear will

display the Challan and Acknowledgement slip for uploaded file.

Click CHALLAN RECEIPT File for downloading and printing the Challan.

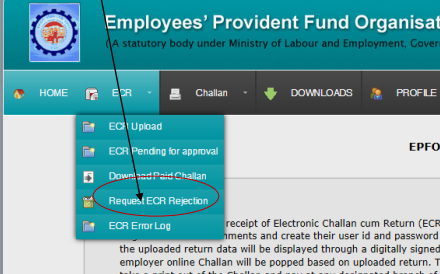

This

step is also available at the following link (REQUEST ECR REJECTION)

12. The

Challan will look as follows: After Printing, manually fill in the details

under “For establishment use only”.

13. The

ECR Acknowledge slip will be as follows.

The challan generated on approval of

ECR will lapse after 15 days if remittance is not made.

Till this stage the

employer can request for rejection of the approved ECR. However if remittance

is made against the ECR, it cannot be rejected.

14. For

Remittance there are two options:

a. If the employer is a CINB (Corporate Internet

Banking) customer of SBI, then he/she can make online payment through the

online SBI portal of SBI.

b. Otherwise the remittance can be made through demand

draft/local cheque in any designated branch of SBI.

15. Once

the cheque against the Challan is realized, you will get SMS

alert. With this the ECR filing process for the month will be complete.

Should you have any queries regarding the

above process, please let us know. You can also share your feedback with us. We’d continue with other remarkable events

in HR Industry this Friday.

Monday, 10 December 2012

Best Practices for Payroll Management

- Extensive chances of fraud with several

real-life situations that can be seen in several organizations on how weak

payroll processes have led to compromising the control environments

- It deals with highly sensitive personal

data

- Payroll costs are usually the most

significant expenditures, especially in service industries.

We are happy to share with you

some of the best practices of payroll management which an organization could implement resulting in both

a stronger, more controlled payroll processing as well as increased

efficiency, and limiting manual intervention:

- Centralized payroll processing – Can

result in non-duplication as well as higher standardization and improved

policy compliance/ monitoring

- Combine Travel and other reimbursements

with the payroll functions there being several synergies in both these

functions

- Direct Credit to Bank Accounts rather

than issuing manual checks (Cheques), including direct credits for full

and final settlements

- Establish performance measures and track

them. Some minimal performance measures should include a. number of

pay-periods where final credit of salaries was done within target date, number

of errors noted, Cost of owning a payroll function, number of cases delays

in receiving inputs etc.

- Integrate time and attendance system,

with the leave system, HR Management system and payroll. Automatic

reconciliation between attendance and leave to ensure accurate days are

considered for payroll processing as well as reducing inconsistencies between

HR Data and Payroll data

- Introduce payroll reconciliation at the

end of the payroll processing. Payroll reconciliation should cover both

head counts and value of gross/ net pay with reasons for variations month

on month. Head count variation would be as a result of additions and terminations

while value based reconciliations could be due to increments, bonuses,

reimbursements, attendance shortfalls etc.

- Ensure a maker-checker on all

non-recurring payroll expenses such as reimbursements, retirement

benefits, final settlements, advances etc.

We hope you found the above tips

useful for your organization. We would be happy to receive your valuable

feedback on the same.

Click here if you are looking to

outsource your payroll.

Subscribe to:

Comments (Atom)